Investing in Private Markets 101

Everything you need to know about investing in private markets

In today's investment landscape, a remarkable transformation is underway. While public markets have long dominated the attention of mainstream investors, the reality is that private markets now represent a vastly larger universe of opportunities.

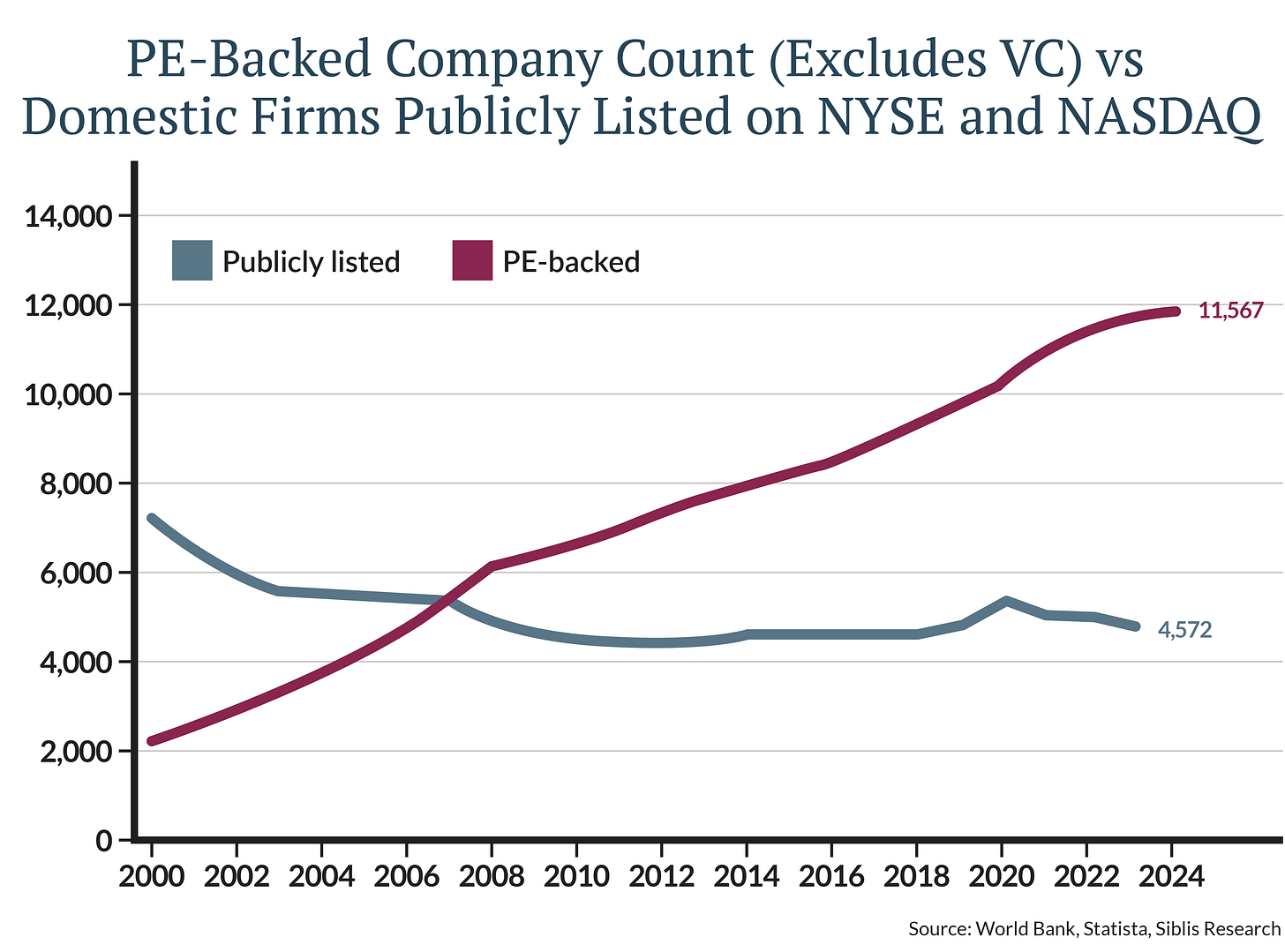

Consider the divergence represented in the chart below — as of 2024, the number of private-equity backed companies outpaces the number of publicly listed companies by nearly THREE times. An IPO market that has largely been frozen since late-2021 has done nothing to help the matter.

This dramatic imbalance illustrates an important point: the majority of economic value creation is happening outside the public markets.

Historically, these private market opportunities were guarded behind exclusive walls, accessible only to institutional investors, university endowments, and ultra-high net worth individuals with deep connections. But this paradigm is rapidly shifting. Private market investments are gradually becoming democratized, with regulatory changes and financial innovation opening doors to qualified individual investors through various channels, including specialized offerings in retirement accounts.

As Robinhood CEO Vlad Tenev recently observed, it's fundamentally unfair that retail investors can freely purchase highly speculative cryptocurrencies (e.g., Memecoins) but are restricted from investing in transformative private companies like OpenAI, Anthropic, SpaceX, and more. This asymmetry in access doesn't serve the interests of individual investors.

For investors considering this expanding frontier, understanding the fundamental characteristics of private market investments is essential. Let's explore the key elements that distinguish them from their public counterparts.

Illiquidity: The Double-Edged Sword

Perhaps the most significant difference between public and private investments is liquidity. Unlike public stocks that can be bought and sold with a tap on your phone, private investments typically lock up capital for extended periods. Valuations are marked quarterly rather than changing by the millisecond, creating a fundamentally different investment psychology.

This illiquidity presents both challenges and advantages. On one hand, you cannot easily access your capital when unexpected needs arise. On the other hand, this forced patience often protects investors from their worst impulses.

I witnessed this phenomenon firsthand during the COVID market crash of 2020. As an investment advisor, my calendar was suddenly flooded with panic-driven client meeting requests when the S&P 500 plummeted 35% in March. However, due to client scheduling constraints, many of these meetings didn't occur until June—by which time markets had dramatically recovered to new highs. Those clients with significant private market allocations had no option but to remain invested, ultimately benefiting from the inability to react emotionally.

The illiquidity of private investments forces a discipline that few investors can maintain independently. When you can't sell in a panic, you're compelled to adopt the long-term perspective that have historically driven superior returns.

Time Horizon: Commitment Required

Private investments demand patience by design. While specific durations vary by asset class, investors should generally expect capital to be committed for 5-7 years at minimum, with some investments extending beyond a decade.

The time horizon typically follows this pattern across major investment categories:

Venture capital: Often 8-12+ years until full realization

Private equity: Generally 5-8 years

Private credit: Usually 3-7 years depending on loan terms

Real estate: Typically 5-10 years for development projects

Most private fund structures include provisions allowing for limited redemptions at specified intervals, but these should be viewed as exceptions rather than reliable liquidity channels.

The fundamental principle remains: private investing should be for capital that won't be needed in the foreseeable future (e.g., for home downpayment, spending needs, etc.)

Return Expectations: The Illiquidity Premium

The extended commitment periods of private investments aren't without compensation. Private markets traditionally offer an "illiquidity premium"—additional returns that reward investors for sacrificing immediate access to their capital.

Historically, private equity has generated returns approximately 3-5% higher annually than comparable public market indices over extended periods. This outperformance isn't guaranteed, but it represents the economic value of patience in markets that increasingly prioritize short-term thinking.

This premium exists partly because private investors can capture value creation stages unavailable in public markets. As companies delay public offerings longer than in previous decades, more growth occurs while they remain private. Investors who can access these opportunities potentially benefit from appreciation that would previously have been available to public market participants.

Risk Profiles: Not All Private Investments Are Created Equal

Just as public market investments span a spectrum from conservative blue-chips to speculative small caps, private investments encompass diverse risk profiles that investors must understand.

Venture capital represents the highest risk tier, focused on early-stage companies with unproven business models but enormous potential. The success pattern in venture is highly asymmetric—often just 10-20% of investments inside a venture capital fund deliver the overwhelming majority of returns. A single blockbuster investment can generate returns that compensate for numerous failing startups. This dynamic makes venture capital both potentially lucrative and inherently volatile.

Private equity spans a broader risk spectrum. Buyouts of established companies with stable cash flows present moderate risk profiles, while growth equity investments in rapidly expanding but unprofitable businesses share characteristics with late-stage venture capital. The risk assessment becomes increasingly nuanced within these categories, based on factors including industry dynamics, leverage levels, and competitive positioning.

Private credit offers more consistent returns with lower volatility, though it sacrifices some upside potential. The risk largely depends on the borrower's creditworthiness and the loan's seniority in the capital structure. With generally higher yields than comparable public debt instruments, private credit has attracted significant capital in prolonged low-interest-rate environments, and continues to garner attention in today’s high rate environment as well given the floating rate structure of specific debt instruments.

Real estate investments present highly idiosyncratic risks tied to property types, locations, development stages, and market cycles. Core holdings in prime markets differ dramatically from opportunistic developments in emerging areas, requiring specific expertise to evaluate effectively. Risk profiles also differ across the wide spectrum of investment types, ranging from multifamily apartments, student housing, data centers, and more.

Conclusion: The Private Market Opportunity

As private markets become increasingly accessible, sophisticated investors will have unprecedented opportunities to diversify beyond traditional public investments. The potential benefits—higher returns, reduced short-term volatility, and access to innovative companies earlier in their lifecycles—make these markets compelling additions to diversified long-term portfolios.

However, the unique characteristics of private investments demand careful consideration. Investors must accurately assess their liquidity needs, time horizons, risk tolerance, and access points before allocating capital to these strategies. When approached with appropriate expectations and allocations, private market investments can significantly enhance portfolio outcomes over complete market cycles.

This introduction merely scratches the surface of private market investing. In future installments, we'll delve deeper into specific strategies, access vehicles, due diligence frameworks, and allocation approaches to help our readers navigate this expanding investment frontier with confidence.

This article on private markets really made me think about how much the landscape of investing is shifting. The comparison between the public and private markets, and how private companies are now outpacing public ones, is pretty eye-opening. It also makes sense that the democratization of these opportunities could give individual investors access to some of the same transformative companies that were once out of reach.

What stood out most to me was the emphasis on the "illiquidity premium" — the idea that by locking up capital and exercising patience, you're potentially rewarded with superior returns. It really shifts the way we think about traditional investments and highlights the importance of discipline and long-term vision.

I think this opens up a lot of possibilities for people who are willing to take on the commitment and complexity of private market investing. It’s not for everyone, but for those with the right mindset, it could be a game changer.